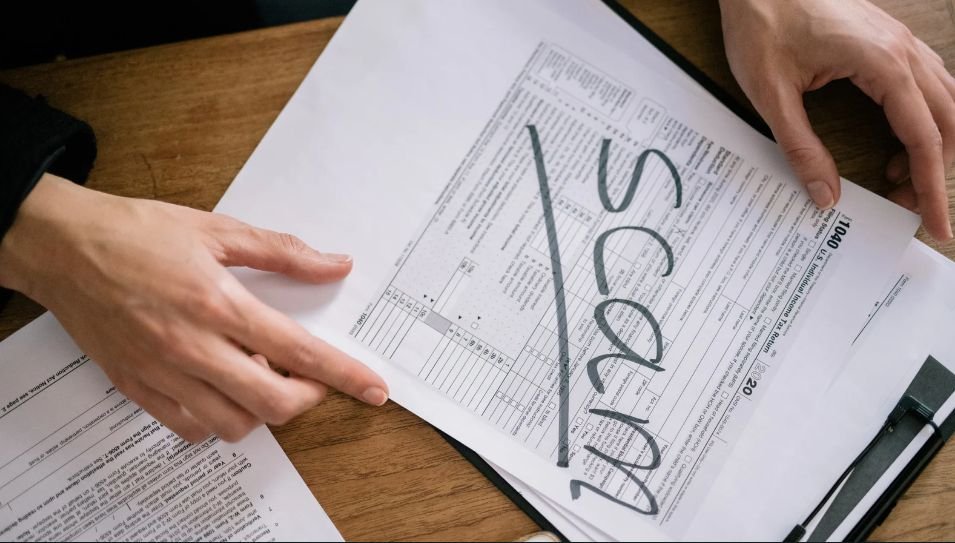

Online job scams are on the rise, targeting job seekers who value flexibility, including military families that frequently relocate. As a financial professional, I emphasize that financial security is not only about managing income and expenses but also about protecting yourself from fraud that can drain your savings and damage your credit profile.

The case I’m sharing here is a real-world example. A military spouse received a text message offering a remote customer service position at a well-known health insurance company. The offer sounded perfect—flexible, high-paying, and doable from anywhere in the United States. Unknowingly, she was stepping into a well-orchestrated scam designed to steal both money and personal identity.

How the Scam Works

The scheme begins with a professional-looking message, followed by an interview conducted via instant messaging apps like Telegram. The scammer, posing as an HR officer, explains the job in detail: $35 per hour, paid training, and flexible hours. The target is then asked to fill out a contract with complete personal information, including a photo ID.

Next comes the fraudulent check, supposedly to cover “work equipment.” The instructions are to deposit the check at the bank, purchase the equipment, and set up direct deposit for salary payments. This is where the financial risk escalates—the check will bounce within days, leaving the victim responsible for repaying the bank.

Why This Scam Seems Convincing

For many, especially those needing extra income, such an offer appears legitimate because it:

- Uses the name of a reputable company

- Includes an official-looking contract and logo

- Offers pay above market average

- Eliminates face-to-face meetings under the guise of “modern hiring methods”

However, in finance, the rule is clear: If something sounds too good to be true, it almost certainly is.

Red Flags to Watch For

According to best practices in financial safety and guidance from the Federal Trade Commission (FTC), here are common warning signs of an online job scam:

- Recruitment conducted solely via text or messaging apps like Telegram or WhatsApp, without a video or in-person interview.

- Instant job offers without a reasonable hiring process.

- Requests for excessive personal data upfront, such as SSN, driver’s license, full address, or signature.

- Email addresses that don’t match the company’s domain.

- Instructions to cash a check and send money back—a classic fake check scam.

- No secure portal for uploading documents. Legitimate companies use encrypted systems.

- Requests for fees or equipment purchases before starting the job.

The Financial Impact of Falling Victim

The losses from these scams go beyond the immediate funds spent. In the context of US personal finance, consequences can include:

- Credit score damage from fraudulent accounts opened in your name

- Loss of savings to repay the bank

- Long-term identity protection costs

- Potential tax issues if your information is used for tax fraud

Proactive Prevention Steps

From a financial expert’s perspective, prevention is key:

- Verify directly with the company using its official HR contact number

- Check the email domain and recruiter’s credentials

- Never share sensitive data before confirming the legitimacy of the job

- Use credit monitoring services for early detection of suspicious activity

- Keep a record of all communications as evidence if you need to file a report

What to Do If You’re Already a Victim

Act immediately:

- Contact your bank to block related transactions

- Alert all three credit bureaus (Equifax, Experian, TransUnion) and place a fraud alert or credit freeze

- Report to the FTC via IdentityTheft.gov

- File a police report for official documentation if necessary

- Enroll in an identity protection service to monitor for misuse of your data

Online job scams are a serious threat to personal financial stability. With the increasing use of technology, scammers’ methods are becoming more sophisticated—even using AI to make interactions appear legitimate. Remember, in any hiring process, healthy skepticism is part of protecting your assets.